When selecting a letting agent in Scotland, deposit compliance and adherence to tenancy deposit protection laws are critical areas to discuss. Failure to do so could result in fines and legal action against you, the landlord. Ensuring your letting agent complies with deposit protection regulations is vital to safeguard your and your tenants’ interests. In this blog, we’ve gone into detail about the things you should look for in a letting agent regarding deposit compliance:

1. Familiarity with Deposit Legislation

Ensure that the letting agent understands and complies with the current Scottish deposit laws, which are set out under the Tenancy Deposit Schemes (Scotland) Regulations 2011. Key aspects include:

- Deposits must be lodged with an approved tenancy deposit scheme within 30 working days of the tenancy start date.

- The agent must provide tenants with key details about the deposit protection scheme, known as the Prescribed Information.

Before entering into an agreement with the letting agent, its important for you to confirm that they have a robust process for complying with these regulations, as failing to protect the deposit on time could result in legal penalties for you, the landlord, including compensation to the tenant (up to three times the deposit amount).

2. Use of a Government-Approved Deposit Scheme

Ensure that the letting agent uses one of the Scottish government-approved tenancy deposit schemes. These schemes ensure that tenants’ deposits are safeguarded throughout the tenancy. The three approved schemes are:

- Letting Protection Scotland (LPS)

- SafeDeposits Scotland

- mydeposits Scotland

Verify with the agent which scheme they use and ensure that it is one of the approved options.

3. Provision of Prescribed Information

The agent must give tenants the following information within 30 working days of receiving the deposit:

- The address of the property.

- The amount of the deposit.

- The date the deposit was received.

- The name and contact details of the tenancy deposit scheme where the deposit is lodged (e.g., Letting Protection Scotland).

- Information about how the deposit will be managed, including the conditions for return and dispute resolution.

Ask the agent about their process for providing this prescribed information and ensure they do it within the legal timeframe.

4. Dispute Resolution Process

The approved tenancy deposit schemes provide a free dispute resolution service if there is a disagreement between the landlord and tenant regarding the return of the deposit at the end of the tenancy. Although this is more difficult to confirm you can the letting agent about any of these processes:

- Is familiar with the dispute resolution process offered by the deposit scheme.

- Has clear procedures in place to manage end-of-tenancy deposit disputes.

- Can demonstrate experience in handling such disputes fairly and efficiently.

5. Accurate Deposit Handling and Record-Keeping

Letting agents should have strict procedures in place for handling deposits, including:

- Keeping accurate records of when deposits are received, protected, and refunded.

- Providing regular statements to landlords confirming deposit lodgement and any changes.

- Ensuring the deposit amount is held in a client money account separate from the agent’s operational funds until it is transferred to the approved scheme.

You can ask the agent for examples of how they maintain deposit records and ensure compliance with the law.

6. Tenancy Agreement Clauses on Deposits

Although tedious, you should review the clauses regarding deposits in the tenancy agreements provided by the letting agent. These should:

- Clearly state the amount of the deposit.

- Outline how the deposit will be protected and managed.

- Detail the conditions under which deductions may be made from the deposit (e.g., for damages, unpaid rent, etc.).

- Set out the timeframe and process for returning the deposit after the tenancy ends, as well as the process for resolving disputes.

Ensure the agent’s tenancy agreements are clear, legally compliant, and include deposit protection details. If you are unclear on any of the details of a tenancy agreement, you should always be able to query it with the letting agent.

7. Transparency and Communication with Landlords

A reputable letting agent should keep you informed about the deposit process, including:

- Confirming that the deposit has been lodged with a scheme like Letting Protection Scotland.

- Providing you with copies of documentation provided to tenants.

- Updating you on any issues with the deposit, such as disputes or delays in returning the deposit.

Ask the agent how they communicate with landlords regarding deposit compliance and what documentation you can expect.

8. Client Money Protection (CMP)

While deposit protection is essential, it’s also important to check that the letting agent has Client Money Protection (CMP) insurance in place. This insurance ensures that if the agent mishandles client funds (including deposits), the landlord and tenant will be compensated. Make sure your agent can confirm they have CMP coverage. If the letting agent is accredited with any major industry bodies such as ARLA Propertymark or Safeagent they should have CMP. For more information, have a look here at mygov.scot.

9. Registered Letting Agent and Compliance with Code of Practice

In Scotland, letting agents must be registered with the Scottish Letting Agent Register and comply with the Letting Agent Code of Practice. Check that:

- The agent is registered and in good standing with the Scottish Letting Agent Register.

- They follow the Code of Practice, which includes specific rules about managing deposits and ensuring compliance with tenancy deposit regulations.

You can verify the agent’s registration online via the Scottish Letting Agent Register to ensure they meet all legal requirements.

Summary: Key Questions to Ask the Letting Agent:

- How do you ensure compliance with the Tenancy Deposit Schemes (Scotland) Regulations?

- Which government-approved tenancy deposit scheme do you use (e.g., Letting Protection Scotland)?

- How do you handle deposit disputes, and what is your approach to dispute resolution?

- Can you show proof of client money protection insurance?

- What is your process for providing prescribed information to tenants regarding their deposit?

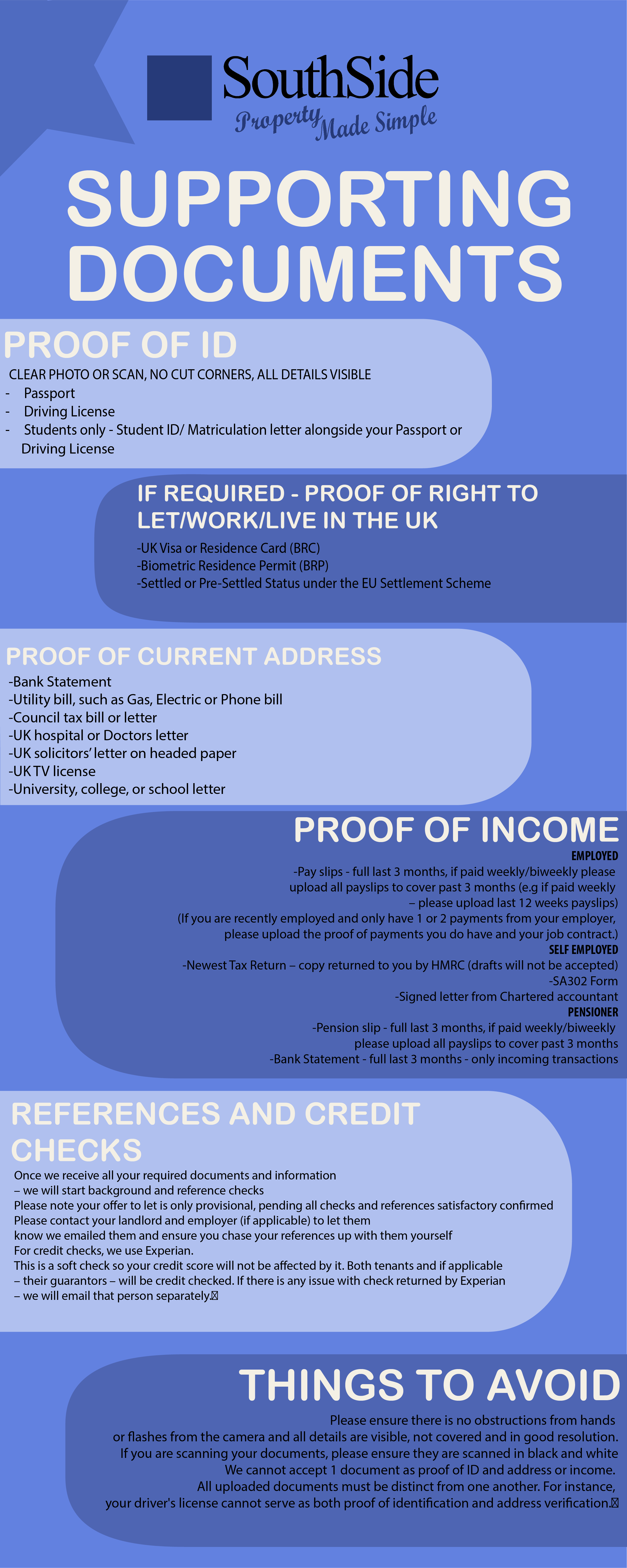

At SouthSide Property Management we are more than happy to answer any questions you may have. We are accredited with ARLA Propertymark, Safeagent and others. We ensure that all our tenancy deposits are handled with care and have robust procedures in place to make the whole process easy and straight forward for everyone involved. Get in touch today so we can discuss your property portfolio.